Get All the Data You Need with one Robust, Dependable Database with 25,000+ Transactions.

Built by a Business Valuation Expert for Fellow Professionals.

The Only Business Valuation Database Offered as an

AICPA FVS Member Benefit.

Merger and Acquisition Data

Customize Your Searches For Ease of Use and Search On the Go:

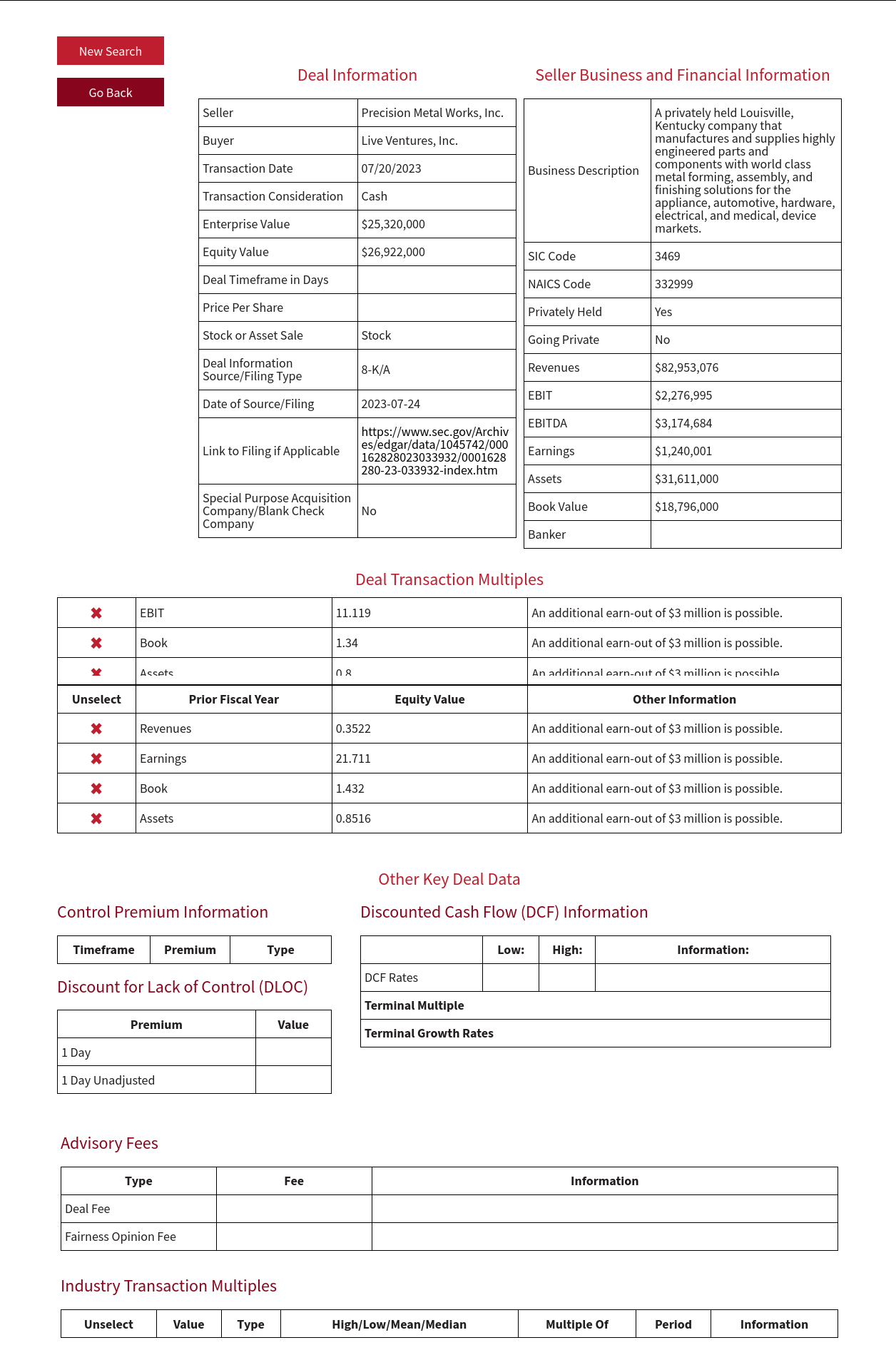

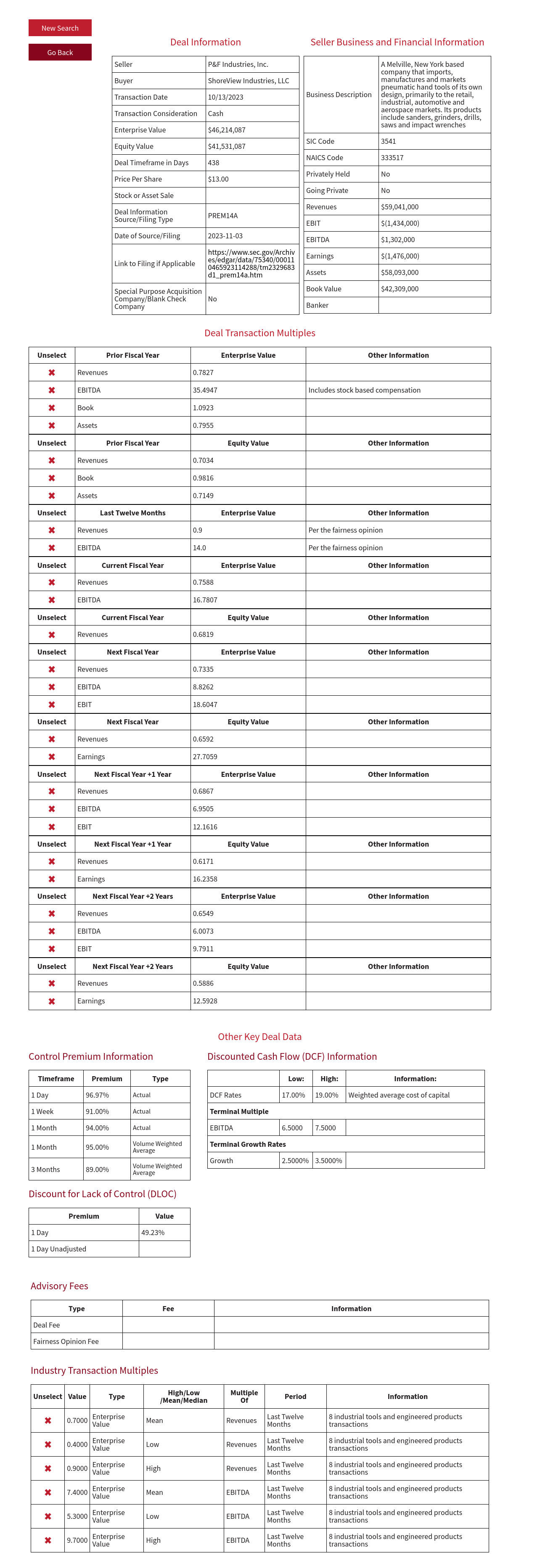

Search over 25,000+ publicly traded and privately held company M&A transactions on your desktop, laptop or cell phone.

Tailor your searches by date, buyer, seller, industry (SIC and NAICS codes), seller financial information, deal size, keywords and more.

Easily edit existing search criteria and delete transactions you do not want to keep; plus you can save your searches to easily re-run them later.

Get Everything you Need to do a Business Valuation in One Cost Effective Database:

For your Market Valuation approach get equity and enterprise transaction multiples of revenues, operating income, EBITDA, earnings, assets, book value and more for the prior fiscal year, last twelve months, current fiscal year, current fiscal year +1 and current fiscal year + 2; plus get specialized industry multiples such as the PV10 value in the oil and gas industry, assets under management in the investment management industry and RevPar in the lodging industry.

For your Income Valuation approach get Discounted Cash Flow (DCF) Data including discount rates, growth rates and terminal values.

For your valuation discount for lack of control (DLOC), you can search for control premiums paid by specific type and time frame. We provide both the one day discount for lack of control and one day unadjusted discount for lack of control.

Get nearly 12,000 privately held transactions all from public, verifable sources that you can rely on whether in client reports or the courtroom.

Get nearly 12,000 privately held transactions all from public, verifable sources that you can rely on whether in client reports or the courtroom.Get Unique Search Features for Even Greater Value:

Search MergerShark's Discount for Lack of Marketability (DLOM) Stock Options model which uses long term equity anticipation (LEAP) calls and puts using a proprietary group of 30 large publicly traded companies to calculate a DLOM. The 30 large capitalization publicly traded companies we use cover a broad range of industries, are actively traded, and the discounts are therefore truly market based, timely and not subjective. We update this discount monthly for 6, 12, and 24 months’ timeframes. You can also search the last three years historical and statistical information for these time periods. This robust search feature is useful whether you are doing a valuation report at a current date or historic one and need to get an excellent starting point for your DLOM.

Search for the deal timeframes in days. This is the number of days from when the Board or management of a company decides to sell the company until the deal is signed. This is useful for helping you determine a likely timeframe to use in your lack of marketability discount.

Get the investment banker or advisor to a transaction, as well as the investment banker or advisor fees paid for fairness opinion and deal.

You can search for commercial or savings bank only deals and get banking specific multiples, such as equity value to book value, tangible book value, deposits and core deposit premiums.

You can search by payment type and select cash only, stock only or cash and stock deals.

You Get Convenience and Confidence with MergerShark:

After tailoring your search and selecting what transactions to keep from your search results, download your search results and statistics into Excel for easy use in your valuation schedules.

Get transaction source data for full transparency. MergerShark is adding the transaction source or filing type, the date of the source or filing and a link to the source if applicable. Plus, we do not accept transactions from business brokers in exchange for free subscriptions, so rest assured, you can independently verify MergerShark's data if needed and comfortably and confidently depend on it in your client reports or litigations.

MergerShark was founded by business valuation expert Brian Pearson, CPA/ABV/PFS/CFF ASA, MBA. Brian is the founder and managing member of Valuation Advisors, LLC, which conducts valuations of privately held businesses for a wide range of financial and tax transactions. Brian has been collecting the data that comprises MergerShark for over 15 years. Originally, he was using it internally in his own business valuation practice, but he decided to take the data he found useful and offer it to his fellow professionals in a multi-faceted, affordable business valuation database.

Fair Value Amortization Period Data

Get Hard Data to Justify Your Accounting Decisions:

Purchase price allocations can be significant and time consuming challenges and assigning useful lives is often ambiguous and subjective.

With MergerShark you will get access to data on the amortization period assigned to various finite assets from prior deals.

Get access to thousands of transaction data points on Fair Value.

Transactions can be searched by Fair Value items (examples: customer relationships, non-compete agreements, existing technology) and by time period, industry, deal size, seller financial data, keywords and more.

Easily and quickly benchmark how intangible assets are amortized.

Board of Directors' Compensation Data

Having a Well-Composed Board of Directors is More Important, but Harder than Ever

Prior to an IPO or period of corporate restructuring companies often need counsel for how to best compensate their boards.

A well composed board is essential to the effectiveness and performance of every public company.

The pressures, demands, scrutiny, challenges and risk members board of directors face continue to increase.

Board members may face disclosure of personal information, fulfillment of fiduciary duties, large time commitments, travel commitments and individual committee duties.

Board members also face shareholder proposals, activism and litigation, proxy contests, the challenge of recruiting new members, regulatory and reporting requirements, liability under securities laws, rapidly changing and competitive market conditions and unusual or emergency situations amongst other things.

There has been an increase in regulatory changes, proxy disclosure rules, shareholder activism and litigation and negative media attention surrounding director compensation.

Companies need a board with directors that are well-qualified, independent, have specialized and valuable expertise and are diverse by demographic characteristics, experience and length of service.

The market to attract board directors is increasingly competitive.

Directors now have to dedicate more time to their position, take on more risk and meet higher qualification requirements.

Many directors are accepting fewer board positions and many companies have director tenure limits and restrictions on how many other boards their directors can serve on.

Potential directors want to serve on well-managed boards that will offer professional and personal rewards for companies with great leadership.

You Can Attract the Best Directors with Competitive Compensation

MergerShark's database contains data on board of directors' compensation from over 3,000 Initial Public Offerings.

Get data on the various types of board and committee payments for each company and the form of payment (cash, stock, options, etc.).

Quickly run searches targeted by industry, market capitalization, financial metrics, price per share, payment form, payment time, time period and keywords.

Establish how comparable companies are compensating their board.

Director compensation must be competitive to attract quality directors and appropriate for the time, energy and risk of serving.

Director compensation has increased as have the methods and design of compensation programs.

Director pay should be targeted to be competitive with the market.

Director pay should be comparable to a company's pay peer group used to benchmark executive pay and a large data set of comparably-sized general industry companies.

Justify board payment and compensation recommendations for your client or company with objective and quantitative data.

Are You an AICPA Forensic and Valuation Services Section Member?

The American Institute of Certified Public Accountants (AICPA), internationally known as the Association of International Certified Professional Accountants (AICPA), the world's largest member organization for the accounting profession, representing close to half a million members, tested MergerShark and wanted to offer to their Forensic & Valuation Services (FVS) section members as a member benefit.

AICPA FVS members get MergerShark for free for 2026 as a member benefit. Members may sign up for free at any time while the member benefit is offered.

Join your colleagues using MergerShark today!

To get your free MergerShark subscription click here

You need to know MergerShark will help you get the robust data you need easily

and is a database you can depend on in your

client reports, presentations and the court room.

You can sign up for the free one day trial pass.

Run unlimited searches, download up to 1,000 transactions and use MergerShark data in your reports with citation.

Head over to our pricing page to get your free day pass.

You can also set up short, personalized online demonstration, which many others have found useful.

Email contact@mergershark.com to schedule an online demo

for you and anyone else at your firm at your convenience.